It’s getting hot out there. When picking your emerging market investments, be mindful of its exposure.

Headlines

- WSJ – Russian Builds Up Army Near Ukraine Border 8/19. “Russia’s plans around the Ukrainian border show a real intent to use force if needed.” – Anton Lavrov

- FT – RBS to start charging large UK clients to hold cash 8/19. The Royal Bank of Scotland has become the first UK Bank to start charging its larger corporate customers for holding their cash… more to follow.

- WSJ – Oil Market Boost May Come from Venezuela, Not Algeria 8/19. “Venezuela produced the least oil in June in over 13 years and output had declined by more than 200,000 barrels a day in just the first half of 2016. That is half an Alaska’s worth of output.”

- NYT – Nearly 1,800 Killed in Duterte’s Drug War, Philippine Police Official Tells Senators 8/22. Three weeks ago the number was 420. Duterte was only sworn into office seven weeks ago. Careful who you vote for.

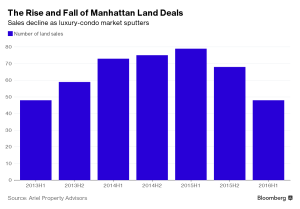

- Bloomberg – NYC Apartment Tower Without Tenants for Sale as Buyers Swarm 8/17. For those not in real estate, delivering an empty high-rise to the market is just plain crazy… a symptom of the low interest rate environment.

Briefs

- Bruce Kelly of InvestmentNews does a good job of highlighting some of the structural problems the nontraded REIT industry faces now that real estate valuations have gotten quite rich.

- The nontraded REIT industry is having a hard look at itself. Inland is eliminating its transaction fees and new entrant to the sector – but definitely not to institutional real estate investment – Blackstone Group has not committed to a specific yield – the primary attribute for selling these investments.

- The thing is “Cap rates, a key valuation measure for real estate, have decreased dramatically since the credit crisis, while valuations of quality properties have increased. That means commercial real estate is simply too pricey to generate the promised returns (generally 6-7%) brokers need to pitch nontraded REITs to clients.”

- “The math of these programs is much more challenging today. Cap rates are lower and I think the dividend yields have to come down. The publicly traded REIT market is paying a 3.5% dividend yield, on average.” – Allan Swaringen, president and CEO of JLL Income Property Trust

- And with a lower fee structure I might add…

- One thing to be mindful of in investing in nontraded REITs are their dividend coverage ratios. “That ratio, a REIT’s cash flow versus its dividend, or distribution, is one of the most important metrics for investing in nontraded REITs, which often resort to returning investor cash to pay for or cover the 6% or 7% dividend. Any return of investor money diminishes the REIT’s ability to perform in the long term.”

- Bottom line, “nontraded REIT sponsors and advisers who sell them can say au revoir to the product’s most important marketing component: the promise of generating annual returns of 6% or 7% to yield-starved investors.”

- Min Jeong Lee, Yuko Takeo, and Nobuyuki Akama of Bloomberg covered the profit slump of Japanese corporates and the trouble that lurks.

- “Trends that slammed profit in the first quarter – a stronger yen, negative interest rates and slumping China growth – haven’t reversed. At stake is a second straight year of earnings decline that could buy Prime Minister Shinzo Abe’s push for companies to boost capital spending and raise wages to spur economic growth.”

- “With negative interest rates grinding away bank profits and a stronger yen bearing down on carmakers, aggregate operating income plummeted 17% in the June quarter, the biggest quarterly decline since 2011. That’s the year an earthquake in Fukushima and subsequent tsunami caused the yen to gain and stocks to drop.”

- Laura Kusisto of the Wall Street Journal drew attention to a disrupter (Host Compliance) of a disrupter (Airbnb).

- Airbnb has changed the short-term rental business in a big way. The company “now operates in 34,000 cities around the world and was recently valued by investors at $25.5 billion.”

- On top of that, Airbnb has created an ecosystem of other companies that help landlords rent, maintain, and operate their units…

- Well one of the recent companies created, Host Compliance, is the ‘tit for tat.’ Rather than assist people to attain the most out of their Airbnb listings, the company actually is set up to help cities and municipalities in the policing of their short-term rental regulations by sifting through the vast amount of listings data and providing reports on violations.

- No surprise, most governments are overwhelmed and not truly set up to properly track abuses to their rules, hence they’re always playing catch up to tech innovators. I suppose it won’t be long that other tech innovators will pop up to “check-in” on other tech disrupters…

- Eliot Brown of the Wall Street Journal focused his spot light on the real estate market of San Francisco and the effects of the surging tech market.

- As the tech industry continues to boom, its companies continue to crowd out other businesses from San Francisco’s office market, ultimately reducing the city’s “economic diversity, giving it an enormous concentration in an industry that is particularly prone to economic swings.”

- “Tech companies now occupy more than 29% of the city’s occupied office space, according to real-estate-services firm CBRE Group Inc. That is roughly double what the industry occupied in 2010 as well as the height of the dot-com bubble in 2001, CBRE said.”

- “What’s more, the bulk of those occupying that office space are startups or those that recently went public, typically unprofitable companies that are considered some of the most volatile.”

- “Looming in the minds of many in San Francisco is the city’s experience after the dot-com bust of 2001. Even though the tech sector was centered more in Silicon Valley to the south, the local economy was pummeled. Office vacancies soared above 20% from less than 4%, according to Cushman & Wakefield.”

- Gabriel Wildau of the Financial Times reports that it was only a matter of time that Chinese regulators would tighten the noose on the P2P market.

- China has just formalized new regulations for the Peer-to-Peer (P2P) market in the country. “Regulators and courts have previously issued many of the prohibitions contained in the latest rules in different forms, but the latest regulations mark the first comprehensive framework for regulating P2P lenders in China.”

- “The rules, issued on Wednesday, forbid online lenders from accepting deposits or guaranteeing principal or interest on loans they facilitate. They ban P2P platforms from securitizing assets or offering debt transfer mechanisms that mimic securitization. Companies are prohibited from using P2P platforms to finance their own projects.”

- “Their fundamental nature is information intermediation, not credit intermediation.” – banking regulator

- “Outstanding loans from 2,349 P2P platforms totaled Rmb621bn by the end of June, the banking regulator said in a statement on Wednesday. But an additional 1,778 ‘problem platforms’ have also been established, equal to 43% of all platforms.”

- “The latest rules also prohibit P2P groups from operating ‘fund pools’ in which investor funds are not matched with specific loan assets. The banking regulator noted that ‘Ponzi schemes’ – in which inflows from new investors are used to finance payouts on maturing obligations – have been a problem for the industry.”

Special Reports

- Oaktree Memo – Political Reality – Howard Marks 8/17

- FT – Pensions: Low yields, high stress – John Authers and Robin Wigglesworth 8/22

- With a median 401(k) account balance of $104,000 for US households near retirement, that would imply a $4,000 annual income should they follow standard withdrawal practices.

- Mauldin Economics – Renzi’s Great Gamble – Nick Andrews and Stefano Capacci 8/24

- Italian Prime Minister Matteo Renzi has put forth a referendum to vote this upcoming October that would enable him to move forward some much needed reform in the country. Should a “No” vote succeed, it “…will not just precipitate the fall of Renzi’s government; it could throw Italy’s long term membership of the eurozone into doubt, plunging the single currency area once again into crisis.”

Graphics

CBO – Trends in Family Wealth, 1989 to 2013 8/18

FT – Pensions: Low yields, high stress – John Authers and Robin Wigglesworth 8/22

FT – US charitable foundations hit by plunging returns 8/23

Featured

*Note: bold emphasis is mine, italic sections are from the articles.

Think It’s Hot Now? Just Wait. Heidi Cullen. New York Times. 20 Aug. 2016.

“July wasn’t just hot – it was the hottest month ever recorded, according to NASA. And this year is likely to be the hottest year on record.”

“Fourteen of the 15 hottest years have occurred since 2000…”

Silver lining…good for solar.

As China nears exhaustion investors must look elsewhere. James Kynge. Financial Times. 24 Aug. 2016.

As yield is vanishing from developed world economies – there is $13tn in negative-yielding debt outstanding at the moment – emerging market economies have seen a lot of interest of late… however, try to see it in context.

“The drive behind this intense demand for EM has nothing to do with EM. The one thing that emerging markets have that everyone wants right now is not raw materials or cheap labor, it’s yield. When you have negative interest rates in Europe and Japan, and zero rates everywhere else, the politics and economics of these countries becomes irrelevant.” – Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch

“Thus, emerging markets are flattered by a perception they are the least bad option for investors.”

However, investors need to be wary of the exposure that many EMs have to China.

China is having ever greater difficulty in producing economic growth – at least of the levels of the past few decades (which is to be expected). “Before the global financial crisis in 2008, China needed just over one dollar of credit to deliver one dollar of gross domestic product growth, the ratio is now six to one, according to Morgan Stanley.”

“Although the economy is said to be growing at 6.7%, investment growth by private companies slowed to 2% in July, demonstrating that the most potent force in the Chinese economy sees scant hope of a return.”

“Scarcity of opportunity amid an abundance of growth defines China’s enervated state. So generous have banks, capital markets and shadow financial institutions been to virtually anyone who wishes to borrow that almost every industry is in a state of oversupply, slashing profits.”

“Standard & Poor’s, the credit rating agency, is the latest to raise the alarm. The anemic profits of Chinese companies is likely to intensify their need to borrow more merely to repay maturing debts, helping to drive global corporate debt levels to worrying levels by 2020.”

“Corporate debt is set to expand by half to $75tn over the next five years, according to S&P. China’s share of this debt is likely to rise to 43% in 2020 from 35% in 2015, the rating agency said, largely through companies borrowing to repay debts that are coming due.”

Bottom line, don’t throw out your fundamental analysis models just yet…

Other Interesting Articles

The Economist

- Immigration to Japan – A narrow passage: Begrudgingly, Japan is beginning to accept that it needs more immigrants

- China’s budget deficit – Augmented reality: The fiscal hole is much bigger than meets the eye-but under control

Bloomberg – Why It’s So Hard to Build Affordable Housing: It’s Not Affordable 7/26

FT – We must protect shareholders from executive wrongdoing 8/18

FT – Retailers reveal why US earnings season was fundamentally weak 8/18

FT – Paul Singer says bond market is ‘broken’ 8/18

FT – Venezuela’s problems can no longer be ignored 8/18

FT – Is greed good? No, it’s seriously bad for your wealth 8/19

FT – Hackers expose holes in road for smarter cars 8/19

FT – Oil company dividends: flare-up ahead 8/21

FT – #fintech Sidelining the mobsters in China 8/22

FT – Forget Fed rate calls – be ready for the return of inflation 8/22

FT – China close to launching credit default swap market 8/22

FT – Mongolia tightens belt as debt payments loom 8/24

FT – The canary in the coal mine for China’s currency 8/24

IPE – Redemption requests begin to build among core US property funds 8/24

National Real Estate Investor – Drop in 10-year Treasury Gives Real Estate Pricing a Lift 8/24

NYT – Chilling Tale in Duterte’s Drug War: Father and Son Killed in Police Custody 8/19

NYT – More of Kremlin’s Opponents Are Ending Up Dead 8/20

NYT – The Housing Market Is Finally Starting to Look Healthy 8/23

WSJ – Chinese Bank Shows How To Move Risks Around 8/19

WSJ – One Policy to Rule Them All: Why Central Bank Divergence Is So Slow 8/22

WSJ – China’s Online Lenders Face Peer-to-Peer Pressure 8/25

WSJ – What to Learn From the ECB’s Great European Corporate Bond Squeeze 8/25