Eight massive shifts underway in energy. U.S. men of prime working age are dropping out of the labor force. Venezuela on the brink of social and economic collapse.

Headlines

- WSJ – Global Bonds: Even Further Through the Looking Glass 6/16. Long dated bonds continue to fall – generating outsize returns, but a mean reversion would be crushing.

- FT – China seeks to renegotiate Venezuela loans 6/19. “One fact we shouldn’t overlook is that Venezuela really doesn’t have the money…”

- NYT – Venezuelans Ransack Stores as Hunger Grips the Nation 6/19. “In the last two weeks alone, more than 50 food riots, protests and mass looting have erupted around the country… At least five people have been killed.”

- FT – Hong Kong regains crown in ranking of expensive cities for expats 6/21. For all you expats in case you wanted to know.

- WSJ – Developer Seeks EB-5 Funding for Luxury New York Tower 6/21. The construction financing market is drying up for certain types of projects, so a project for the superrich needs approx. $200m of zero-to minimal cost funds to move forward.

- Bloomberg – Monster Beverage Executives Reap $449 Million From Buyback Offer 6/17. Another of example of compound interest…when the stock awards were granted in 2006 they were projected to appreciate at 10% a year (ending up worth $28.7m each) instead they appreciated at 30% a year (each sitting on gains of $299m).

Briefs

- In the Wall Street Journal, Jacky Wong highlighted how developers in China continue to bid up property prices, interestingly, some of the highest cost transactions are by state owned enterprises involved in businesses that don’t need prime property.

- “Prices for land, the main ingredient of the property world, have hit record highs in auctions this year in many Chinese cities. The average land price per square meter for the top 100 cities in the first five months of this year jumped nearly 50% from same period last year, according to Wind Information. Some land prices are even higher than housing prices nearby.”

- Interestingly, “most of the buyers of the most expensive parcels are state-owned enterprises. A property subsidiary of China Gezhouba Group, a state-owned builder of power plants and dams, spent 3.3 billion yuan last month to buy the most expensive land, in terms of price per square meter, in Nanjing. Another state dam construction company, Power Construction Corp. of China, snapped up a piece of land in China’s bubbliest property market, the southern metropolis of Shenzhen, for 8.3 billion yuan.”

- “The domestic bond market and growth in asset-backed securities have made financing easier for developers, causing companies to chase whatever assets they can. Continuing reforms of state-owned enterprises could also be a trigger, as these firms have incentives to inflate their balance sheets to gain clout in consolidation talks. For some which have already invested heavily in real estate, keeping land prices high makes sense.”

- The Economist provided a nice summary of the impact that the widening of the Panama Canal may have on global shipping.

- In 2015 a record 960m cubic meters of cargo passed through the canal, starting June 26 the canal will have capacity of 1.7 billion cubic meters of cargo annually. “The biggest container ships that could use the old canal, known as Panamaxes, can carry around 5,000 TEUs (20-foot equivalent units, or a standard shipping container). Neo-Panamaxes that will squeeze through the new locks can carry around 13,000 TEUs. Although the world’s largest ships have space for nearly 20,000 TEUs, the majority of the global fleet will now fit through the canal.”

- “America’s east-coast ports should get busier… And vessels carrying liquefied natural gas from America’s shale beds will be able to pass through the locks for the first time, heading to Asia. They are expected to account for 20% of cargo by volume by 2020.”

- Anjani Trivedi of the Wall Street Journal drew attention to the potential credit black hole brewing in China.

- “China’s M1 money supply, a measure of the most liquid assets in the banking system as cash and certain types of demand deposits, is growing at its fastest pace in six years. Meanwhile, M2 money supply, a broader gauge of liquidity including longer-term deposits, expanded at the slowest rate in a year. The ratio of these two rose to its highest since the data has been tracked.”

- “One of the main sources of the rapid M1 growth is troubling: short-term, higher-yielding investments such as wealth-management products in the form of current deposits that now account for 95% of the growth of M1.”

- Yukako Ono and Lucinda Elliott of the Financial Times reported on Nigeria’s recent decision to float its currency on Monday (June 20).

- “Nigeria’s long-awaited flexible foreign exchange rate regime got off to an explosive start on Monday as the naira slid by as much as 27% to N254 to the US dollar.”

- “The currency had been pegged at about N197 per dollar since March 2015. Nigeria, Africa’s biggest economy – where oil exports account for more than 90% of foreign revenue – did not follow other large oil exporting nations which began devaluing their currencies in 2014 as crude prices fell by more than half.”

- “But short-term public finances are still in crisis. ‘Serious domestic reforms are needed that won’t be fixed by the exchange rate normalization,’ Mr. (John) Ashbourne (of Capital Economics) said. As a result of sabotage by resurgent militants in the oil-producing Niger delta, Nigeria has been losing about 700,000 barrels of oil a day. This, and the fall in oil prices since 2014, mean that the state is receiving a quarter or less of what it earned two years ago.”

- As a follow up as of Thursday (6/23), the exchange rate was 283.50 Naira to $1 USD.

- Patrick Jenkins of the Financial Times highlighted the slow moving financial crisis that is underfunded pensions.

- “A recent report by Citigroup shone a light on just how big a nightmare is looming. It found most pension plans in the US and UK are underfunded, with an aggregate 18% deficit.”

- “Government pension schemes are in an even worse state. Citi found the value of unfunded or underfunded liabilities for 20 OECD countries is $78tn – nearly double the $44tn published national debt number.”

Graphics

WSJ – Why China’s Developers Can’t Stop Overpaying for Property – Jacky Wong 6/19

WSJ – Credit Black Hole – Anjani Trivedi 6/20

FT – Nigeria’s currency tanks against dollar on float – Yukako Ono and Lucinda Elliott 6/20

Featured

*Note: bold emphasis is mine, italic sections are from the articles.

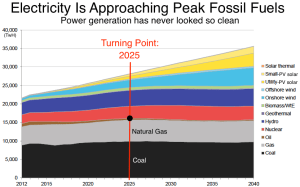

The World Nears Peak Fossil Fuels for Electricity. Tom Randall. Bloomberg. 12 Jun. 2016.

“The way we get electricity is about to change dramatically, as the era of ever-expanding demand for fossil fuels comes to an end – in less than a decade. That’s according to a new forecast by Bloomberg New Energy Finance (BNEF) that plots out the global power markets for the next 25 years.”

“Call it peak fossil fuels, a turnabout that’s happening not because we’re running out of coal and gas, but because we’re finding cheaper alternatives. Demand is peaking ahead of schedule because electric cars and affordable battery storage for renewable power are arriving faster than expected, as are changes in China’s energy mix.”

The eight massive shifts underway:

- There Will Be No Golden Age of Gas

- “The cost of wind and solar power are falling too quickly for gas ever to dominate on a global scale, according to BNEF.”

- “The peak year for coal, gas, and oil: 2025.“

- Renewables Attract $7.8 Trillion

- “Humanity’s demand for electricity is still rising, and investments in fossil fuels will add up to $2.1 trillion through 2040. But that will be dwarfed by $7.8 trillion invested in renewables, including $3.4 trillion for solar, $3.1 trillion for wind, and $911 billion for hydro power.”

- “But by 2027, something remarkable happens. At that point, building new wind farms and solar fields will often be cheaper than running the existing coal and gas generators.”

- “By 2028, batteries will be as ubiquitous as rooftop solar is today.”

- Electric Cars Rescue Power Markets

- “The adoption of electric cars will vary by country and continent, but overall they’ll add 8% to humanity’s total electricity use by 2040, BNEF found.”

- Batteries Join the Grid

- “The scale-up of electric cars increases demand for renewable energy and drives down the cost of batteries. And as those costs fall, batteries can increasingly be used to store solar power.”

- Solar and Wind Prices Plummet

- “For every doubling in the world’s solar panels, costs fall by 26%, a number known as solar’s ‘learning rate.’ Solar is a technology, not a fuel, and as such it gets cheaper and more efficient over time. This is the formula that’s driving the energy revolution.”

- “Wind-power prices are also falling fast – 19% for every doubling. Wind and solar will be the cheapest forms of producing electricity in most of the world by the 2030s, according to BNEF.”

- Capacity Factors Go Wild

- The capacity factor (essentially the efficiency ratio) for renewable energy technologies is getting much better.

- “Once a solar or wind project is built, the marginal cost of the electricity it produces is pretty much zero–free electricity–while coal and gas plants require more fuel for every new watt produced. If you’re a power company with a choice, you choose the free stuff every time.”

- A New Polluter to Worry About

- “China’s evolving economy and its massive shift from coal to renewables mean it will have the greatest reduction in carbon emissions of any country in the next 25 years, according to BNEF.”

- But, “India’s electricity demand is expected to increase fourfold by 2040” and they have tons of coal which they intend to use.

- The Transformation Continues

- Unfortunately, the shift to renewables is not happening fast enough…

US low-skill males drop out of jobs market. Sam Fleming. Financial Times. 20 Jun. 2016.

“Labor-force participation among men of prime working age has dropped by more in the US than in any other OECD country apart from Italy in the past quarter century.”

A recent report from the Council of Economic Advisers “shed light on one of the major concerns about America’s recovery: while unemployment has been falling, a large number of people have also been dropping out of the jobs market altogether.”

“Among so-called prime-aged men between the ages of 25 and 54, the participation rate fell more steeply than in all but one other country in the OECD from 1990 to 2014, the report found. It is now the third-lowest among 34 OECD nations.”

The report found that “this fall in the prime-age male labor force participation rate, from a peak of 98% in 1954 to 88% today, is particularly troubling since workers at this age are at their most productive.”

“The analysis shows that participation rates have diverged sharply between people who have a college degree or more, and those who do not. In 1964, some 98% of prime-age, college-educated men participated in the workforce, compared with 97% of those with a high-school degree or less. By 2015, the rate for college-educated men had slipped to 94%, while that for those with a high-school degree or less had plunged to 83%.”

Further, “more than a third of those prime-aged men who are outside the workforce are living in poverty, suggesting their decision to drop out is not a choice they made because they had other sources of income.”

Is Venezuela close to boiling point? Pan Kwan Yuk. Financial Times. 21 Jun. 2016.

You’ll note this week that there is a lot of coverage on this topic from the NYT piece about Venezuelans ransacking stores for basic goods, to the Bloomberg Businessweek article on how weak government structures fall apart when climate stresses get added to the mix, to the Financial Times article on how Chinese government officials have been meeting with the opposition politicians in Caracas to ensure that their loans will eventually be paid. Bottom line, things are coming apart at the seams.

“Venezuela is on the brink of economic and social collapse. There is a high chance of a sovereign default and a removal of the president over the next eighteen months.” – Capital Economics

“The worst part of this story is that Venezuela hasn’t hit bottom yet – the only light at the end of this tunnel seems to be from another of a series of oncoming locomotives.” – Russ Dallen, managing partner at Caracas Capital Markets

“The violent food riots that have swept the country are but the latest sign that things in Venezuela might have reached a boiling point. The collapse in the bolivar “fuerte” – or strong bolivar – which is trading close to 1,100 per dollar in the black market – is another. To put this in perspective, the country’s biggest banknote – the 100 bolivar – is now worth just a mere 9 US cents.”

Other Interesting Articles

Bloomberg Businessweek

- When the State Wilts Away: In weak nations, environmental stress can tip society into catastrophe

- The Louisiana Way To Health Insurance

- Risky Reprise of Debt Binge Stars U.S. Companies Not Consumers

- Warren Buffett’s Dicey Power Play

- Qatari Fund Buys $2.5 Billion Singapore Tower From BlackRock

- Life in the People’s Republic of WeChat

The Economist

- College towns – A roaring trade

- Oil supply – Rigonomics: Is $50 a barrel enough to revive global production?

FT – Nigeria changes course with painful devaluation 6/16

FT – Whatever happened to the China crisis? 6/19

FT – Perverse incentives lie behind Microsoft’s LinkedIn purchase 6/19

FT – Egyptians rush to invest in property to counter the pound’s slide 6/19

FT – Hedge funds seek long term money for distressed debt wagers 6/20

FT – Central banks’ front-loading leaves modest pickings for investors 6/20

FT- Chinese banks brace for storm in face of shadow finance calm 6/20

FT – The corn shortage that Brazil really can’t afford 6/21

FT – China bankruptcies surge as government targets zombie enterprises 6/22

MarketWatch – A storm is brewing in the real-estate market, Pimco warns 6/20

Vanity Fair – Leaked Documents Reveal How Much Uber Drivers Really Make 6/23

WSJ – Apartment Boom Needs Cooling-Off Period 6/16

WSJ – China’s Short-Term Lending Boom Won’t End Well 6/16

WSJ – Losers Abound in $7 Billion Chinese Takeover Scuffle 6/20

WSJ – Rents Are Booming, But for How Long? 6/21

Yahoo Finance – Jim Chanos shreds ‘shameful’ Tesla-SolarCity deal 6/22