Whoa, that’s a lot of corporate debt… So, who is going to pay for China’s corporate debt balance? High Yield Bond Market decoupling from reality.

Headlines

- WSJ – Hanjin’s Demise: Why Global Shipping Glut Isn’t Going Away 9/2. “Despite efforts to consolidate and idle fleets, container ship capacity is growing at 3.2% a year, while demand for container cargo is a tepid 1.8%…”

- WSJ – Now Companies Are Getting Paid to Borrow 9/6. First governments, now companies (in this case Sanofi and Henkel) are issuing debt at negative yields…thank you very much.

Briefs

- Mark Melkin of ValueWalk covered a trend that the world seems to be following that Japan is leading.

- “The ‘Japanization’ of the global economy marked by transition to low growth and low inflation has started to attract investor attention as a phenomenon in recent years. There has been scarcely any nominal GDP growth over the past 20 years in the Japanese economy.” – Daiju Aoki, analyst at UBS Japan

- “Demographics are triggering the lack of GDP growth. As a society ages, its population becomes more dependent on government services and less productive in terms of generating goods and services.”

- Japan’s peak worker to dependent ratio was in 1990.

- Robin Harding of the Financial Times highlighted how the Bank of Japan vows to keep on keeping on with the easing of monetary policy.

- “Mr. Kuroda, governor of the BoJ since 2013, claimed the central bank’s policies ‘have contributed significantly to the positive turnaround in Japan’s economy’ and said there was no chance of reducing the level of monetary accommodation.”

- “‘It is often argued that there is a limit to monetary easing but I do not share such a view,’ Mr. Kuroda told an audience in Tokyo. He said there was ample room for the BoJ to buy more government bonds, to cut interest rates further, or to buy other assets such as corporate bonds, equity and real estate funds.”

- “Yet despite the high level of monetary stimulus, the latest date show a 0.4% fall in the consumer price index compared with a year ago, and a slowdown in inflation even excluding volatile food and energy prices.”

- “Mr. Kuroda argued that the failure to hit 2% inflation so far is because of three shocks: falling oil prices since summer 2014, weakness in demand after raising Japan’s consumption tax in April 2014, and a slowdown in emerging markets from summer 2015.”

- “Given that, said Mr. Kuroda, ‘it is imperative for the Bank firmly to maintain its commitment to achieving the price stability target of 2% at the earliest possible time.”

- Katie Martin of the Financial Times illustrated a plea by Citi for central banks to not buy so many bonds.

- “Please don’t buy so many bonds, Mr. Central Banker. It is rapidly becoming a case of ‘too much of a good thing’.” – Hans Lorenzen, credit strategist at Citi Research

- Private investors are being crowed out…

- And markets are being driven by macroeconomic policies more and more…

- Brian Blackstone and Tom Fairless of the Wall Street Journal posed the question: Could the European Central Bank start buying stocks?

- As the European Central Bank (ECB) is running up against its self-imposed limits on how much of a country’s debt it can hold and since there simply aren’t enough bonds they can buy that qualify under their guidelines, the ECB is contemplating buying European equities.

- “Some central banks already invest in equities. Switzerland’s central bank has accumulated over $100 billion worth of stocks, including large holdings in blue-chip U.S. companies such as Apple and Coca-Cola.”

- The Bank of Japan holds ¥10.182 trillion (approx. $98 billion) of “individual stocks and exchange-traded funds as of Aug. 20, in terms of book value.”

- Though “economists have been split over the costs and benefits. Some say that Japan’s capital market can no longer accurately price the value of stocks; too much BOJ money has flown into some specific companies. Others say it has helped prop up share prices, thus producing ‘wealth effects’ to help the economy fight deflation.”

- Interesting times.

- Costa Paris and Erica E. Phillips of the Wall Street Journal highlighted how Hanjin’s shipping troubles has resulted in about $14bn of cargo stranded at sea.

- “Since Hanjin Shipping Co. of South Korea filed for bankruptcy protection there last week, dozens of ships carrying more than half a million cargo containers have been denied access to ports around the world because of uncertainty about who would pay docking fees, container-storage and unloading bills. Some of those ships have been seized by the company’s creditors.”

- According to Lars Jensen, chief executive of SeaIntelligence Consulting in Copenhagen, “43 Hanjin ships are en route to scheduled destinations with no guarantees that they will be allowed to unload. An additional 39 are circling or anchored outside ports. Eight ships have been seized by creditors.”

- All told about $14 billion worth of cargo is stranded at sea with the crews running short on rations…

Special Reports / Opinion Pieces

- FT – Taking the Long View in investing: eight lessons – John Authers 9/1

- “To sum up ten years in one paragraph: a historic speculative bubble in credit finally burst, and the US came out ahead thanks to looser monetary policy and swift action to fix its banks, while emerging markets slowed down, and Europe was left behind thanks to its bloated banking system and badly designed currency.”

- NYT – Flooding of Coast, Caused by Global Warming, Has Already Begun – Justin Gillis 9/3

- “Once impacts become noticeable, they’re going to be upon you quickly. It’s not a hundred years off – it’s now.” – William V. Sweet, National Oceanic and Atmospheric Administration

- WSJ – Chinese Billionaire Linked to Giant Aluminum Stockpile in Mexican Desert – Scott Patterson, John W. Miller, & Chuin-Wei Yap 9/8

- So it turns out there is nearly one million metric tons of aluminum being stored in Mexico. “The stockpile, worth some $2 billion and representing roughly 6% of the world’s total inventory.”

Graphics

Fidelity – Five scenarios for stocks – Jurrien Timmer 8/25

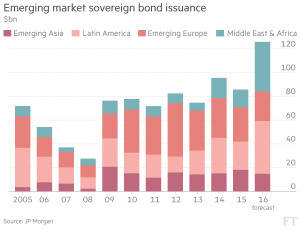

FT – Emerging markets on track to set sovereign debt record – Elaine Moore 9/4

FT – Brazil hopes gambling will reverse its fortunes – Samantha Pearson 9/5

WSJ – Now Companies Are Getting Paid to Borrow – Christopher Whittall 9/6

FT – Why emerging market bonds are not the answer for the yield-starved – Jonathan Wheatley 9/6

FT – Inflation-linked gilt returns have gone through the roof – Joel Lewin 9/6

FT – Three things that could derail the eurozone’s recovery – Mehreen Khan 9/7

Featured

*Note: bold emphasis is mine, italic sections are from the articles.

China: the former EM darling. James Kynge. Financial Times. 1 Sep. 2016.

“For most of the last 15 years, China was a darling for emerging market investors as its demand for commodities lifted the economic fortunes of countries in Latin America, Africa and Asia. But now, as China struggles with the hangover from its debt-fueled boom, fund managers are increasingly shunning Asia’s giant.”

“The main deterrent is China’s corporate debt. Although this issue has been well-flagged in recent years, disquiet over its size and sustainability is deepening. A recent report by S&P Global Ratings, the rating agency, estimates that China’s total outstanding corporate debt in 2015 was $17.8tn, or 171% of GDP, making China’s corporate debt mountain by far the world’s largest in both absolute and relative terms.”

“Not only is the ratio of Chinese company debt to GDP more than double that in the US and eurozone, it is projected to grow far more quickly as an increasing number of heavily-indebted corporations ramp up their borrowing simply to repay debts that are coming due. By 2020, China’s outstanding corporate debt will be $32.6tn, while its share of global company borrowings will have risen to 43% from 35% last year, according to S&P estimates.”

“The S&P report estimates that $13.4tn, or nearly half, of total credit demand in China by 2020 will be for refinancing purposes.”

While there are many differences of opinion as to how this shakes out, with either a major meltdown or some internal growing pains (and everything in between), we shall see. Either way, keep an eye on this one.

Does It Matter If China Cleans Up Its Banks? Michael Pettis. Mauldin Economics. 31 Aug. 2016.

This article really follows the one above and I highly recommend reading the whole thing.

Let me try and paraphrase: imagine you’re a new company and you want to take on debt to help you grow the business. Okay, sounds good and it works. The additional debt allows you to buy assets that help you to become more productive and hence grow sales/profits faster than the amount of debt and its associated servicing costs. Boom, you’re a hero and making lots of money.

So you do this some more and some more and some more. Eventually, your rate of productivity slows for every piece of debt you take on. Oh and did I mention that because you’ve been rolling over the debt to really juice growth, now your debt balance is quite a bit bigger than your total sales.

Fortunately, your cost of debt is low and you can keep on operating, but your lender is no longer willing to extend you credit, so you start talking to your suppliers to provide you with “credit-like” loans – meaning, hey why don’t you front me some money to buy more products from you and I’ll pay you back once I sell the goods to my customers.

Okay, this keeps on working, but eventually you’re running out of good options so you start looking for your highest possible rate of return projects regardless of the risk… ‘Come on lucky number 7.’

Oh and as to the debt, well, you’ve accumulated so much of it that it has become the lender’s problem and it’s such a big problem that it’s also their depositors’ problem (your mom and pop savers).

So what do you do and who is going to take the ‘haircut’…

The High Yield Bond Market Has Never Been This Decoupled From Reality. Tyler Durden (alias). Zero Hedge. 3 Sep. 2016.

From JPMorgan’s Peter Acciavatti: “Recovery rates in 2016 are extremely low… for high-yield bonds, the recovery rate YTD is 10.3% (10.5% senior secured and 0.5% senior subordinate), which is well below the 25-year annual average of 41.4%… As for loans, recovery rates for first-lien loans thus far in 2016 are 24.5%, compared with their 18-year annual average of 67.2%.”

From Edward Altman of NYU’s Stern School of Business: “Our approach to recovery rates is not centered on sectors. What we’ve looked at carefully over 25 years is the correlation between default rates and recovery rates. As you would expect, when the former rise to high or above-average levels, you always observe the latter dropping to below-average levels. This strong inverse relationship is as much a function of supply and demand as it is of company fundamentals. So if we are expecting a higher default rate in 2016 and even 2017, then we would expect a lower recovery rate. Already in 2015, the recovery rate dropped dramatically relative to 2014 even though the default rate was below average; we saw a 33-34% recovery rate versus the historical average of 45%, measured as the price just after default.”

“In the 30-year life of the so-called junk bond market, the chasm between reality and central-planner-created markets has never been wider.”

Bottom line, despite being able to collect less and less on defaulting debt (meaning you would ordinarily be less eager to buy more high yield debt or at least want greater compensation for the risk), pricing for high yield debt continues to rise…

Other Interesting Articles

Bloomberg Businessweek

- Russia Installs a New Firewall

- The Twilight of China’s Online Consumer Paradise

- Day Trading in Online Ponzi Schemes

- Secret Cameras Record Baltimore’s Every Move From Above

- The Disastrous $45 Million Fall of a High-End Wine Scammer

The Economist

Bloomberg – Another Sign Manhattan Real Estate Is Feeling the Pain 8/31

Bloomberg – Saudi Arabia Said to Weigh Canceling $20 Billion of Projects 9/6

CoStar – Blackstone’s New Non-Traded REIT Begins Selling Shares 9/7

Economist – That 2008 comparison (again) 9/6

FT – Pension solution lies in long-term thinking 8/30

FT – HK property developer hangs hopes on art market 9/3

FT – Shanghai divorces highlight China’s property conundrum 9/4

FT – Why negative interest rates sometimes succeed 9/5

FT – Bank of Japan: great expectations 9/5

FT – Analysts laud ‘remarkable’ pick-up in emerging markets 9/5

FT – China banks shed staff and slash pay in cost-cutting drive 9/6

FT – Rocket’s writedown raises red flags 9/6

InvestmentNews – Ex-CFO at REIT formerly controlled by Nicholas Schorsch indicted 9/8

NYT – Sonia Sotomayor and Elena Kagan Muse Over a Cookie-Cutter Supreme Court 9/5

NYT – Subprime Lender, Busy at State Level, Avoids Federal Scrutiny 9/6

WSJ – Bank of Japan’s New Unease With Negative Rates 9/5

WSJ – The Problem With Dividend Stocks 9/5

WSJ – Why Chinese Bank Stocks Can’t Fly Too High 9/6

WSJ – How China Insurance Crackdown Could Rain on Deal-Making Parade 9/7

WSJ – Europe’s Bond Market: Even Further Through the Looking Glass 9/7

WSJ – Goldman Sachs Has Started Giving Away Its Most Valuable Software 9/7