It’s a low-growth world for us…instead of high returns, we get zilch… Thus it is no surprise that funds are being pushed back to emerging markets in a big way.

Headlines

- WSJ – Annuity Loss Adds to MetLife Drama 8/4. MetLife just took a $2 billion charge on its variable annuity business – the stock market responded by knocking off $4.3bn from the company’s capitalization.

- WSJ – The Insurance Industry Has Been Turned Upside Down by Catastrophe Bonds 8/7. A dry spell in world of catastrophes and low yields elsewhere have brought pension and sovereign wealth funds to the table resulting in a major decline in the cost of risk – also eating away a nice part of the reinsurance industry’s profits.

- Miami Herald – In sign of slowdown, downtown Miami condo prices fall for first time in five years 8/8. “For the first time in five years, resale prices for downtown condos fell, declining 4% to $438 per square foot through the first half of 2016 (the analysis looked at condos built after 2001. Older buildings faced steeper price cuts.”

Briefs

- Bruce Kelly of InvestmentNews covered how the Wall Street titan Blackstone just entered the nontraded REIT market.

- Blackstone Group ($356bn in assets) is getting into the nontraded real estate investment trust business. Its first nontraded REIT – The Blackstone Real Estate Income Trust Inc. – was just registered on Wednesday.

- The REIT is looking to raise $5bn and its manager “will receive a fee of 12.5% of the REIT’s total return after meeting a 5% hurdle.”

- “Capped at close to 9%, the cost structure of the new Blackstone REIT is clearly different than the traditional full-commission nontraded REIT sold mainly by independent broker-dealers such as LPL Financial and Ameriprise Financial Services Inc. Such REITs typically carry loads of 12%, including a 7% (fee) to brokers at the time of sale. Nontraded REITs have been routinely criticized for their high fees and opaque cost structures.”

- “Look for Blackstone to shun the traditional marketplace of independent broker-dealers and turn to wirehouses such as Merrill Lynch and Morgan Stanley, with whom they already have business relationships…”

- In the Wall Street Journal, Richard Barley highlighted how the bond markets are growing ever more bizarre.

- “Central banks have always been able to make waves in markets. But never have they had such far-reaching effects, nor so quickly. The world of bonds is being turned upside down as a result.”

- “The pull to par has become a drag: a buy-and-hold investor is guaranteed to lose money, even before taking inflation into account. The only way to make money is to find another buyer willing to pay a higher price – but that implies a bigger loss down the road.“

- “Germany now has more than €160 billion of zero-coupon bonds in issue. All of its two-year notes pay no interest, along with three of its five-year notes; all of them trade above face value.”

- “The crucial thing to understand is that these instruments are no longer bonds – at least not in the traditional sense. With no income attached to them, they are simply bets on the price another investor is willing to pay. They will also be more volatile: the long wait for repayment means small changes in yield will have a big effect on current prices.”

- Liyan Qi of the Wall Street Journal added context to China’s efforts to reduce the population of Beijing.

- In an effort to reduce the problems from rapid growth and overpopulation, Beijing is seeking to push out residences to neighboring provinces such as Hebei and Cangzhou (see map).

- “Despite the city’s efforts to keep a lid on population growth, greater Beijing now has almost 22 million people, an increase of some 6 million in a decade, official data show. The central area, comprising of six districts grew at an average rate of 414,200 a year over the same period to about 13 million.”

- “Municipal leaders’ latest five-year plan aims to keep greater Beijing’s population under 23 million and to shrink the urban center by 15% by 2020, effectively pushing out some 2 million people – roughly equivalent to excising more than the population of Manhattan from New York City and dispersing those people elsewhere.”

- “The strategy is to move low-end businesses such as wholesale markets, to Hebei-the province surrounding Beijing where growth has flagged-and coax people to follow.”

- Just think what will happen to real estate prices when you push out that much demand…but then again, the laws of economics are generally suspended in China.

Special Reports

- the guardian – 1MDB: The inside story of the world’s biggest financial scandal – The long read 7/28

- A fairly comprehensive story about the 1MDB scandal, the players involved, and the whistle blower who is suffering in a Thai jail until justice can be served – you can bet there will be a movie made… perhaps Red Granite Pictures could produce it…

- NYT – A Surreal Life on the Precipice in Puerto Rico – Mary Williams Walsh 8/6

- NYT – Fractured Lands: How the Arab World Came Apart – Scott Anderson 8/11

- Vanity Fair – A Nobel-Winning Economist Has a Plan to Save Europe – Joseph Stiglitz 8/8

- Each country (or groupings of similar countries) need their own euro set at varying exchange rates.

Graphics

FT – Best coast tech is top and looking to the clouds for growth – Richard Waters 8/4

FT – US economy: Decline of the start-up nation – Sam Fleming 8/4

WSJ – Are Negative Rates Backfiring? Here’s Some Early Evidence 8/8

WSJ – Productivity Slump Threatens Economy’s Long-Term Growth – Ben Leubsdorf 8/9

FT – US bonds: where credit is due – Lex 8/11

Featured

*Note: bold emphasis is mine, italic sections are from the articles.

We’re in a Low-Growth World. How Did We Get Here? Neil Irwin. New York Times. 6 Aug. 2016.

“Slow growth is not some new phenomenon, but rather the way it has been for 15 years and counting. In the United States, per-person gross domestic product rose by an average of 2.2% a year from 1947 through 2000 – but starting 2001 has averaged only 0.9%. The economies of Western Europe and Japan have done worse than that.”

According to a new analysis by the McKinsey Global Institute, 81% of the United States population is in an income bracket with flat or declining income over the last decade. That number was 97% in Italy, 70% in Britain, and 63% in France.”

“An entire way of thinking about the future – that children will inevitably live in a much richer country than their parents – is thrown into question the longer this lasts.”

Bottom line, people are working fewer hours and there is less “economic output being generated for each hour of labor.”

Investing: The great escape. Jonathan Wheatley and James Kynge. Financial Times. 7 Aug. 2016

“The latest growth forecasts from the International Monetary Fund offer some optimism. It expects the pace of gross domestic product growth in emerging markets to increase every year for the next five years while developed markets stagnate.”

“But in truth emerging markets are growing from a shrunken base and a big part of the upturn is not due to things getting better but to things no longer getting worse. Big economies such as Russia and Brazil, for example, in deep recession for the past two years, are finally heading back to growth.”

“Fund flows to EMs have gone through the roof, but this is best described as [the result of] push factors rather than pull factors.” – Peter Kinsella, head of EM research at Commerzbank

“The EM bond rally is really a global fixed income rally.” – David Hauner, head of EM strategy at Bank of America Merrill Lynch

BlackRock’s ($4.6tn money manager) Sergio Trigo Paz, head of emerging markets fixed income, “who changed his view on EM bonds in February, describes what is happening now as a ‘capitulation’ – a realization by big institutions that they can no longer afford to ignore the returns on offer in emerging markets, which have been as high as 13% in the year to date.”

“The impact of such flows on EM sovereign bond prices, which have risen 15% this year, has been amplified by the fact that the asset class is small. An estimated $12tn of developed market government bonds now offer yields of less than zero, while their emerging market equivalents add up to about $800bn, so their ability to offer an alternative is limited.”

“For now, the pressure on prices has all come from buyers and for those who got in early the returns have justified the risks. The trick will be to know when to head for what could quickly become a very crowded exit.”

Other Interesting Articles

The Economist

- After the Arab spring – The ruining of Egypt

- Venezuela – Army rations: Nicolas Maduro turns to the armed forces for salvation

- Tariffs and wages – An inconvenient iota of truth

- Property taxes – Home bias: A taxing problem for foreign buyers (Vancouver)

Bloomberg – Retail Outlets Are on the Outs 8/4

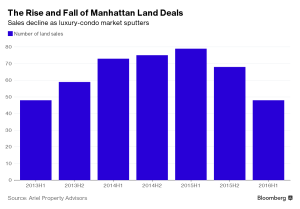

Bloomberg – There Are All Kinds of Signs of a High-End Real Estate Slowdown 8/10

Bloomberg – Blackstone Enters Nontraded REIT Market With $5 Billion Fund 8/10

FT – I’m from the central bank and I’m here to help 8/4

FT – Oil and gas downturn spells trouble for Singapore 8/7

FT – Demand drives $3bn Mexico bond deal at record rate 8/9

FT – Advisors quash Puerto Rico creditor differentiation 8/9

FT – China takes a gamble in scapegoating the west 8/11

NYT – New Photos Cast Doubt on China’s Vow Not to Militarize Disputed Islands 8/8

NYT – Chinese Tech Firms Forced to Choose Market: Home or Everywhere Else 8/9

WP – Venezuela’s death spiral is getting worse 8/8

WSJ – When Chinese State Support Evaporates on Investors 8/8

WSJ – New Rules and Fresh Headaches for Short-Term Borrowers 8/8

WSJ – WeWork Misses Mark on Some Lofty Targets 8/9

WSJ – The Typical Home in San Jose Now Costs More Than $1 Million 8/10

WSJ – Lopsided Housing Rebound Leaves Millions of People Out in the Cold 8/10

WSJ – Why China’s Bond Market Rally Is Risky Business 8/10

Yahoo Finance – Macy’s plans to close 100 stores, boost online investment 8/11